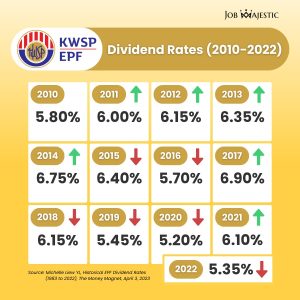

The Employees Provident Fund (EPF) has had a history of adjusting its dividend rates annually, reflecting the fund’s financial performance. Here’s a summary of the EPF dividend rates for the last few years.

2010: The dividend rate was declared at 5.80%.

2011: EPF announced a dividend rate of 6.00%, the highest in the preceding decade.

2012: The dividend rate increased to 6.15%.

2013: EPF declared a 6.35% dividend rate.

2014: The rate further increased to 6.75%.

2015: A slight decrease was observed, with a dividend rate of 6.4%.

2016: The rate decreased to 5.7%.

2017: The dividend rate increased to 6.9%.

2018: EPF declared a 6.15% dividend rate.

2019: The dividend rate decreased to 5.45%.

2020: A slight decrease was observed, with a dividend rate of 5.2%.

2021: The dividend rate increased to 6.1%.

2022: EPF declared a 5.35% dividend rate.

The performance of the Employees Provident Fund (EPF) takes into account various factors like investment diversification across sectors and locations. As of December 2022, foreign investments constituted 36% of the EPF’s assets, contributing significantly to its income. The number of active members also increased beyond pre-Covid-19 levels, with a distribution of 53% active to 47% inactive members.

The dividend rates are calculated using a formula that factors in net income, investment, non-investment income, expenses, and the starting balance of contributions. However, both the board and the Minister of Finance must approve the final rates according to the EPF Act of 1991, which stipulates a minimum 2.5% annual dividend rate. Nonetheless, Malaysians are advised not to depend solely on EPF for retirement savings. Other financial products like Private Retirement Schemes (PRS), unit trusts, and life insurance policies are also suggested for a more secure retirement fund.

EPF Dividend Rate 2023 / 2024

The Employees Provident Fund (EPF) for 2023 is forecasted to announce a dividend rate between 5.5% and 6.5%, outperforming 2022’s conventional and Shariah savings rates of 5.35% and 4.75%, respectively. These estimates leverage the favorable investment returns in recent years, propelled by the fund’s noteworthy performance in the first three quarters of 2023 and the lack of special drawing programs.

Dividend rate specifics for 2024 have yet to be available and are typically announced the following year, suggesting details might become available in early 2025. These figures are based on the EPF’s solid management, strategic investments, and overall economic growth and stability. Still, they’re estimates— the official dividend rate will be revealed upon the EPF’s announcement.

Source: Business Today, New Straits Times, NST – EPF 2023

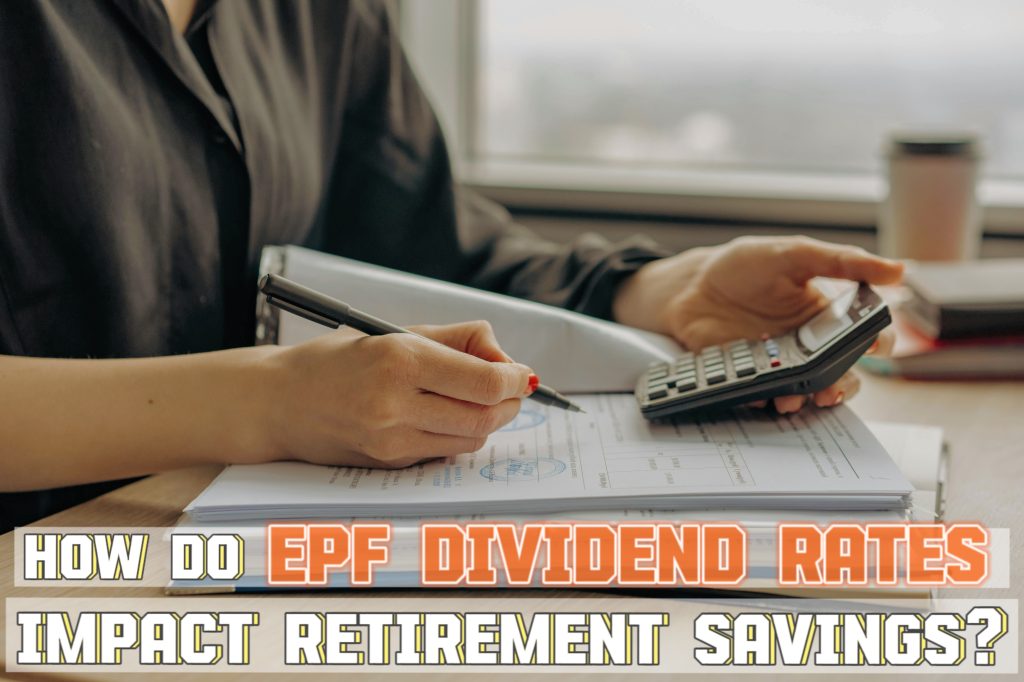

Why it is important?

The Employee Provident Fund plays a crucial role in providing financial security, particularly in times of crisis or emergencies. Contributors like Nurul Kamal and Mimie Harrie noted that access to the fund through a flexible account can be a financial lifeline, especially concerning the increasing cost of living and inflationary pressures.

EPF allows individuals to withdraw during emergencies, relieving unexpected financial stress. However, it is essential for contributors to exercise financial responsibility when accessing these funds, only using them when genuinely required. Overall, the importance of the EPF lies in its ability to offer a financial safety net and enable better management of one’s financial stability during tough times. The proposed advent of flexible EPF accounts as part of the 2024 Budget only underscores this significance, affording contributors greater control over their savings.

Source: The Star – It could be a lifeline for us, say EPF contributors

What are the benefits of EPF for employee and employer?

Employees

1. Retirement Savings

The EPF is a way for employees to save money over the long term to build up money while working. It ensures people have a cash safety net when they hit retirement age.

2. Guaranteed Returns

Employees who put money into the EPF get a nice yearly bonus and a safe and steady return on their investment. Most of the time, this dividend rate is better than other banks’ average interest rate.

3. Accessible Housing Financing

People who are part of the EPF can use some of their savings to buy a house or pay down the balance on their home loan. This feature makes it easier for workers to buy houses and lowers housing costs.

4. Insurance Coverage

In an unfortunate incident, such as death or total permanent disability, EPF provides insurance coverage to members, ensuring their dependents are financially protected.

5. Education Withdrawals

Members of the EPF can take money out to pay for their own or their children’s schooling. This benefit lets them go to college without worrying too much about money.

Employers

1. Legal Compliance

Employers in Malaysia are obligated to contribute to the EPF. Employers can prevent penalties or legal complications by ensuring compliance with the law by fulfilling this requirement.

2. Employee Loyalty and Engagement

An employer’s contribution to the EPF signifies their commitment to ensuring the financial stability of their employees. Employees may develop a greater sense of engagement and loyalty, boosting their motivation and output.

3. Employee Retention and Attraction

An employer’s contribution to the EPF signifies their dedication to safeguarding their employees’ long-term financial welfare. As an esteemed employment benefit, the EPF may facilitate attracting and retaining talented personnel.

4. Reduced Employee Financial Stress

Employee retirement savings through the EPF minimise financial stress and worry. This action can boost productivity, lower absenteeism, and promote workplace wellness.

5. Government Incentives

Employers in Malaysia who make contributions to the EPF are eligible to receive specific tax incentives and benefits. These incentives may assist organisations in reducing their overall operational expenses.

How to Calculate?

A portion of your monthly income, usually 11% of your base salary, is deducted and deposited into a personal EPF account. This is the fundamental principle underlying EPF. This sum increases gradually as a result of the fund’s investments. The purpose of these savings is to ensure that you have financial security in retirement.

For example:

– Employee earns a basic salary of RM3,500 per month and the EPF contribution rate is 11%, the employee’s contribution to the EPF would be RM 3,500 x 11% = RM 385 per month.

– Employer also contributes 12% of the employee’s basic salary, the employer’s contribution would be RM 3,500 x 12% = RM 420 per month.

Calculate the returns on the investments as the next step. The EPF board invests the contributions provided by the employee and the employer, and the earnings produced on these investments are credited to the employee’s EPF account. The EPF board’s investments may have an impact on the returns received.

– if the returns earned on the investments in a particular year are 5%, the returns earned on a balance of RM 20,000 would be RM 20,000 x 5% = RM1,000

The EPF balance is determined by adding the total contributions and returns.

– Total EPF balance

= (RM 385 x 12 months [employee]) + (RM 420 x 12 months [employer]) + (RM 1,000 [return on investment])

= RM 4,620 + RM 5,040 + RM 1,000 = RM 10,660

Below are more examples to provide a better understanding:

| Basic Salary | Returns earned on a balance | Calculation | Total EPF balance |

| RM 4,000 | RM 20,000 | RM 4,000 x 11% = RM 440 (employee) RM 4,000 x 12% = RM 480 (employer) RM 20,000 x 5% = RM 1,000 | (RM 440 x 12 months) + (RM 480 x 12 months) + RM 1,000 = RM 12,040 |

| RM 4,500 | RM 20,000 | RM 4,500 x 11% = RM 490 (employee) RM 4,500 x 12% = RM 540 (employer) RM 20,000 x 5% = RM 1,000 | (RM 490 x 12 months) + (RM 540 x 12 months) + RM 1,000 = RM 12,360 |

| RM 5,000 | RM 20,000 | RM 5,000 x 11% = RM 550 (employee) RM 5,000 x 12% = RM 600 (employer) RM 20,000 x 5% = RM 1,000 | (RM 550 x 12 months) + (RM 600 x 12 months) + RM 1,000 = RM 13,800 |

How to Check?

The Employees Provident Fund (EPF) has announced dividend rates for the year 2022, with a declared rate of 5.35% for Conventional Savings, amounting to a payment of RM45.44 billion, and a rate of 4.75% for Shariah Savings, totaling RM5.70 billion. This brings the overall payment for the year 2022 to RM 51.14 billion.

To check your EPF dividend online, follow these simple steps using i-Account:

1. Visit the official website at www.kwsp.gov.my.

2. Navigate to the Login icon.

3. Enter your registered ID and Password.

4. Click on View Details in the Dividend section of the menu.

5. Details of the Dividend will be displayed.

By accessing your i-Account, you can conveniently review and track your EPF dividend information online. EPF members must stay informed about their dividend rates, as this contributes to their overall retirement savings. For a more comprehensive understanding of your EPF dividends, consider exploring additional features and information available on the official EPF website.

Stay proactive in monitoring your EPF dividends through i-Akaun, ensuring you are well informed about your financial standing and retirement savings progress.

Job Seekers and Employers Unlock Your Career Potential with Job Majestic! Explore the Features, Benefits, and Unique Opportunities Awaiting You. Ready to Elevate Your Job Search Experience?

Dive into the World of Job Seekers Today and Take the Next Step in Your Professional Journey!

![]()