Introduction of Account Persaraan, Account Sejahtera, and Account Fleksibel

In a significant move for Malaysian workers, the Employees Provident Fund (EPF) has announced plans to revamp its account system. This overhaul, unveiled in late April 2024, introduces fresh names for existing accounts and adds a new option for contributors.

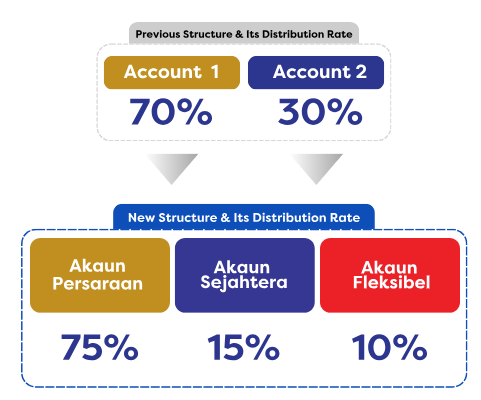

EPF’s restructuring aims to better meet contributors’ financial needs by transitioning from two to three accounts. The new structure includes:

- Account Persaraan: Focused on retirement savings.

- Account Sejahtera: Designed for well-being during retirement.

- Account Fleksibel: A newly introduced account for short-term financial needs.

Under this new framework, contributions will be distributed as follows: 75% to Account Persaraan, 15% to Account Sejahtera, and 10% to Account Fleksibel. Members below the age of 55 will experience automatic restructuring, with the opportunity to transfer savings from Account Sejahtera to Account Fleksibel. This transfer mechanism ensures all members, regardless of their account balance, receive a significant initial sum in Account Fleksibel, thereby enhancing flexibility and financial planning capabilities. To learn more about Account 3 and determine your withdrawal eligibility, you can read the full details on the EPF website.

Facilitating Withdrawals: Utilising Account Fleksibel

Account Fleksibel allows members to withdraw funds at any time, with a minimum withdrawal amount of RM50. Withdrawal requests can be easily made online through the KWSP i-Akaun platform or in person at any EPF branch nationwide. Members who haven’t registered with KWSP i-Akaun are encouraged to do so to streamline the withdrawal process from Account Fleksibel.

Extension of Restructuring to All EPF Members

This comprehensive restructuring initiative is set to extend to all EPF members, including non-Malaysian contributors, who have not yet reached the age of 55 as of May 11, 2024, ensuring that a broad range of individuals benefit from these enhanced financial planning and savings options.

Account 55 and Account Emas

Upon reaching the age of 55, members will see the consolidation of all savings from Account Persaraan, Account Sejahtera, and Account Fleksibel into Account 55. Subsequent contributions received by members aged 55 and above will then be directed to Account Emas.

Digital Alternatives for Fund Withdrawals

The introduction of Account 3 has generated significant interest, with Malaysians lining up as early as 7 in the morning. Many believed they would be among the first, only to find others had arrived even earlier. Some chose to skip the queues by withdrawing funds via the KWSP i-Akaun app or i-Akaun (Member) Web Portal.

EPF Account 3 “Unauthorised Withdrawals” Scam

With the new account’s implementation, numerous scams have surfaced, claiming unauthorized withdrawals or similar issues to deceive individuals. Members should exercise extra caution when making withdrawals. For more information about these scams, read more here.

Conclusion: Embracing the Changes

The account restructuring represents a significant shift aimed at enhancing financial security and flexibility for all members. By understanding the new system and utilizing the available tools and resources, you can better manage your savings and ensure a secure financial future. Whether planning for retirement or addressing immediate financial needs, the new EPF accounts are designed to support you every step of the way. Stay informed, stay cautious, and make the most of the benefits offered by the revamped EPF system.

![]()